Record 0DTE Volume in 2025 Has Changed the Game We wrapped up 2025 with the S&P 500 up 18% for the year—a solid result in the face of tariff headlines, global conflicts, and inflation concerns. One of the major options market stories of the past year has been the growing role of 0DTE options: same-day expiration […]

negative gamma

Subdued Volatility and the Setup Into Year-End

Subdued Vol Meets Negative Gamma Weakness in AI-related stocks dominated market headlines last week, most notably for Oracle and Broadcom. This pushed the market downward, before the rebound on Thursday and Friday. Despite the market trending down for three consecutive days, implied volatility remained surprisingly subdued: put skew remained average, and ATM implied volatility sat […]

FOMC Reset: Vol Crushes, Stocks Lift Higher

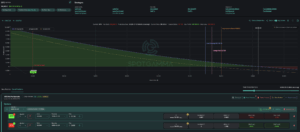

Last week began with quiet anticipation of Wednesday’s FOMC. When the Fed announced the 25 basis point rate cut and Treasury bill purchases, the reaction was immediate. Equities surged, with the SPX breaking out above our 6,845 Volatility Trigger to approach all-time-highs near the 6,900 resistance level. The options market had priced in meaningful event-related volatility surrounding FOMC, and […]

Nomura: “Max Short Gamma” Pain… But Relief Is Coming

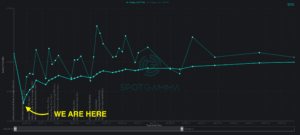

Via ZH: Earlier this week we pointed out a bizarre divergence in the “greeks” – while the Nasdaq had slumped into negative gamma territory, which is where dealers are forced to sell more as the Nasdaq slides lower creating a feedback loop where selling begets selling, even as the S&P still remained in positive gamma […]

Nomura June OPEX Update

“Following Friday’s Serial/Quarterly options expiry, we continue to see potential for a ‘Gamma Unclenching’ over the following 1w-2w period with currently ~47% of the $Gamma set to run-off” – Nomura’s Charlie Nomura marks a much lower gamma flip point of June options expiration, which would suggest markets may open in more positive gamma territory after […]

June Selloff Review

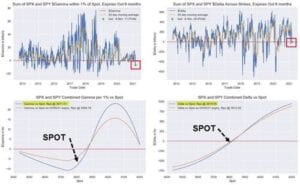

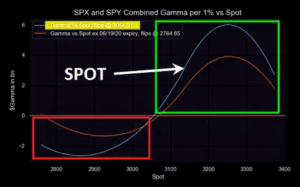

Markets were unable to hold gains on Friday after a sharp selloff on Thursday. While we initially opened over the gamma flip zone, markets broke that 3075 area and immediately sold down to the 3000 strike. This 3000 level is where we calculated the most options gamma and served as support. All of these levels […]

Zero Gamma = Zero Gravity

We posted a few days ago about the “right” tail risk and the possibility of a market rally. In a note to subscribers we added to this, suggesting the market may be in an airpocket. Specifically: “zero gravity”. Most of you are probably familiar with those flights which take you to the edge of space […]

Corona Market: Reviewing Right Tail Risk

This is being written just before the 3/26 unemployment data release which is forecasting as much as 2 million unemployment due to the economic shutdown related to Coronavirus. There is also a Stimulus Bill “pending“. While we are all aware of the downside risks here, here is a scenario for a major move to the […]

SpotGamma Report for: 03/13/2020 AM

### You must be logged in to access this content. Don’t have an account with SpotGamma? Sign up today to view unique key levels, Founder’s Notes, market commentary, options analysis tools, and expert insights. If you’re already a SpotGamma subscriber, log in here: Username or E-mail Password Remember Me Forgot Password

The Friday Option Position “Blowout”

ZeroHedge posted an article Friday that caught a lot of attention. Basically they claim that a firm got a tap on the shoulder from the risk department and were forced to close out positions. This may also have been a Margin Call. If someone got tagged (allegedly) doesn’t really matter to us, what happened in […]