Last week began with fear dominating market sentiment: analysts widely attributed Tuesday’s 2% SPX selloff to Greenland worries and tariff threats. As we pointed out in last weekend’s newsletter, traders had begun hedging against downside risk as put skew increased and volatility premiums rose. However, the quick turnaround back to SPX 6,900 seemed to erase any […]

SPX

Defensive Positioning Emerges as Market Rallies

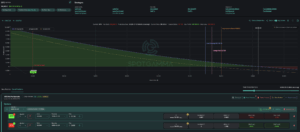

Traders Turn Defensive In the Face of Market’s Climb SPX tested fresh all-time highs last week, with positive gamma providing guardrails for the broader market. In the face of headline noise—from criminal investigations into Powell to Iran-related escalation—the market absorbed every dip, with the 6,890 Risk Pivot level from Monday’s AM Founder’s Note holding firm. However, increasing put skew and […]

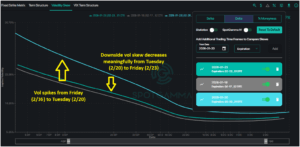

Vol Stays Quiet as SPX Reaches All-Time Highs

Strong 0DTE Support Lifts the Market to Record Highs The S&P 500 kicked off 2026 by grinding through a week of macro data releases to finish at fresh all-time highs on Friday. SPX closed at 6,966, up from the 6,902 open on Monday, after finding critical support in the 6,890–6,900 zone multiple times throughout the […]

Record 0DTE volume reshapes the S&P 500

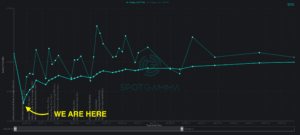

Record 0DTE Volume in 2025 Has Changed the Game We wrapped up 2025 with the S&P 500 up 18% for the year—a solid result in the face of tariff headlines, global conflicts, and inflation concerns. One of the major options market stories of the past year has been the growing role of 0DTE options: same-day expiration […]

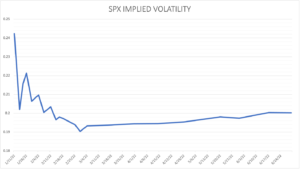

Subdued Volatility and the Setup Into Year-End

Subdued Vol Meets Negative Gamma Weakness in AI-related stocks dominated market headlines last week, most notably for Oracle and Broadcom. This pushed the market downward, before the rebound on Thursday and Friday. Despite the market trending down for three consecutive days, implied volatility remained surprisingly subdued: put skew remained average, and ATM implied volatility sat […]

This SPX Trade Hit Big With 12:1 Reward-to-Risk Payoff Using TRACE & HIRO

Searching for high payout, same-day trades? See how professional trader Doug Pless sold a 0DTE SPX Iron Condor to exploit the negative gamma environment on November 13, 2025 — powered by TRACE, HIRO, and Key Gamma Levels. The result? A 12:1 reward-to-risk payoff. Here’s how: Author: Doug Pless Professional Trader & SpotGamma Content Contributor The […]

Put-Covering Rallies & Signals in Our SPY Gamma Exposure (GEX)

The big question: Was that rally all put covering? Signals in SpotGamma’s custom SPY GEX say “Yes” This week the S&P500 rallied ~3% to close the Liberation Day downside price gap (red horizontal line). This led the S&P500 to notch a 9-day win streak – the longest such streak since November 2004. With that, the VIX […]

The Anatomy of an SPX 0DTE Driven Market

U.S. equities surged on May 12, 2025, as the S&P 500 closed +3% to 5,848, with intraday action reflecting a more modest 0.23% gain, after the U.S. and China agreed to a significant 90-day reduction in reciprocal tariffs. What did any of this have to do with 0DTE SPX options? Hint: The 0.23% intraday gain. The Anatomy […]

Next Week’s Fed Meeting May Create Massive Moves In The Market

The following is a guest post courtesy of Michael Kramer of Mott Capital Management. Stock market volatility has picked up, and it may only be starting. Investors are eagerly awaiting the next FOMC meeting on January 26 to try and gauge which way the Fed may choose to go in its fight with inflation. With […]

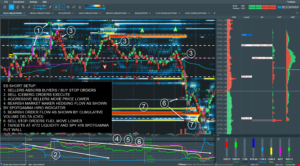

Trade Analysis: ES Futures (29 December 2021)

The following is a guest post from Doug Pless. When I plan to trade futures, I begin my morning preparation by reading the SpotGamma AM Founder’s Note. For ES futures, I note gamma levels, the SpotGamma Imp. 1 Day Move, the SpotGamma Gamma Index, and Gamma Notional for SPX and SPY. I also look up […]